Case Study is the description of a problem and its solution. Well-done case studies reveal the problem studied, identifying it as a common phenomenon.

Problem solving theories are more easily applied when there is evidence of their previous successful application.

Case Study is pedagogical for solving a problem, theories of causes and prevention. The decision maker with a similar problem can make better inquiries about the solution method.

Check out Montax’s various Case Studies to see if we can help you.

Case Study – Housing Program “Minha Casa Minha Vida”

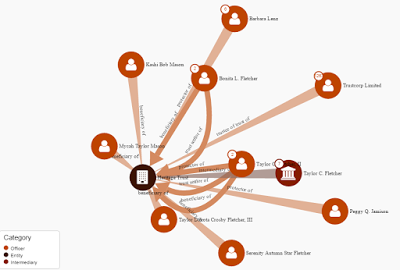

Evidence of fraud in the execution, “laundering” or concealment of assets accessed by Montax Intelligence allowed the unavailability of assets of all companies of a civil construction economic group and their partners after abandoning works of the Minha Casa Minha Vida housing program of the federal government in partnership with Caixa Econômica Federal (CEF) in the State of Pará (Brazil).

Montax discovered an equity holding company and that the partners of the insolvent construction company, in the pre-bankruptcy stage, transferred the shares of their equity holding company to their respective mothers.

The assignment of social quotas took place shortly before the controller attended the Hearing at the Public Ministry of Labor to close an agreement with the Union of the category.

The agreement had not been fulfilled.

Case Study – Giants Background Check

A giant in the US beverage industry is considering hiring a CEO of a Brazilian beverage giant for the position of director of foreign operations and consulted Montax Intelligence for background checks (criminal, civil and professional) of the national executive.

In just 72 hours, Montax confirmed the professional record, checked the civil record and found only 1 criminal record regarding the alleged tax evasion allegedly carried out in favor of the Brazilian beverage company.

Asked about the content of the Complaint, the initial part of the Criminal Action, Montax suggested the client from abroad to consult a sworn translator and a criminal lawyer specialized in Economic Criminal Law, professionals legally authorized to give an opinion on the matter, however, warning that the person consulted has no other criminal records, has an excellent reputation in the domestic market and the complexity of tax and labor laws in Brazil often generates unfair claims against directors of companies with operations in Brazil.

Case Study – Corporate Fraud

The “animal protein” commodity industry has grown a lot in recent years, either due to demand from Class C or from demand from China and the Middle East.

One of the three partners of one of the biggest animal food manufacturers suspected that he was being passed over.

Montax Intelligence discovered the fraudulent scheme and obtained evidence of corporate fraud, which basically consisted of the transfer of the company’s fixed and intangible assets to “clone” companies owned by the partners, who traded directly with the parent company’s customers and suppliers.

From fraud to tax evasion and “laundering” or concealment of assets, rights and values ??in the form of real estate fixed assets registered in the corporate name and CNPJ (tax number) of equity holdings opened in the name and CPF (personal tax number) of the children and spouses of the fraudster partners, the company was practically emptied.

Montax identified the equity holdings and the properties absorbed by them with company revenues, as well as evidence of the abuse of legal personality and equity confusion, requirements of economic integration through disregard (normal and inverse) of the legal personality that would allow civil liability (indemnity) of the defrauded partner by all “clone” companies, holdings and their partners In law and in fact

Case Study – Partner Withdrawal Simulation

A European supplier of automotive parts has been “defaulted” by one of Brazil’s biggest customers, a distributor that is also a manufacturer of competing automotive parts.

But the investigation had nothing to do with a conflict of interest.

The European client needed to locate assets of the debtor company and partners to improve the effectiveness of the asset recovery lawsuit.

Montax Intelligence discovered evidence of the crime of execution fraud, characterized by a sophisticated system of patrimonial shielding: One of the partners simulated his withdrawal from the society, taking with him as “indemnification” the company’s fixed real estate assets.

A simulated asset emptying.

Montax accessed evidence that the exclusion of the partner was only “on paper”, the list of company assets transferred to the name/CPF of the excluded partner and even listed other assets of the partners.

Case Study – Foreign Trade, Money Laundering

Few companies generate as much money as foreign trade, international trade in agribusiness commodities, such as beef, corn and soybeans.

We are not talking about ships, but producers and intermediaries, people who guarantee that a large volume of seeds will arrive at the port on the agreed day.

Producers, cooperatives and intermediaries buy “seeds” and receive them in advance.

Montax Intelligence has already investigated many of these cooperatives and foreign trade companies and found that some simply “disappear” after gaining the trust of foreign customers eager for Brazil’s commodity.

On one occasion, a cooperative that negotiated with China, Europe and the Middle East stopped delivering goods after receiving more than US$ 20 millions.

Montax identified that its controller had a factory that did not generate profit – where the money of foreign trade customers was going -, opened a false international trade company abroad and made investments in another partner company in the United States of America.

Simple investigative due diligence or background checks would reveal that the controlling partner, a former Protestant pastor with many lawsuits, had no good reputation.

In addition to business abroad, Montax discovered real estate investments away from the company’s headquarters, but in cities where he was emotionally linked, an asset research premise that we explain in our online course Success in Execution and Pledge, Creditor Manual – Financial Intelligence for Asset Search and Credit Recovery.

Case Study – Pre-Bankruptcy Metallurgy

China “broke” many businesses in America, especially in Brazil, where the business environment was no longer the best.

The most affected sector was the Secondary Sector (manufacturing and basic industry).

And the industry most affected was steel and metallurgy. With debts of approximately US$ 2 millions to a Montax Intelligence consultant, we discovered that a metal materials factory is in a pre-bankruptcy state, and what is worse, of insolvency because it has debts of more than US$ 30 millions.

One of these debts dates back to the 1990s.

Failure of compliance, counterintelligence and corporate security led the supplier to the error of delivering products without any guarantee of payment.

Montax identified the extension, all the companies of the debtor economic group, especially the patrimonial company registered in the name of the children of the controlling patriarch.

This patrimonial company houses many rural areas and land in small towns in the interior.

The 2 asset shielding strategies of

a) investments on behalf of third parties (“strawman “) and

b) investments away from the controller’s domicile or the headquarters of the companies controlled by it.

These tactics were used together, but were no match for Montax Analysts.

Case Study – Retail and Risk

Selling everything to everyone, especially C and D consumers, is a good business strategy, right?

Not in times of economic crisis.

A creditor investment bank hired Montax Intelligence to identify equity companies and locate financial assets held by the shareholders of one of the largest retail groups in Brazil, currently under bankruptcy protection.

The bank creditor suspected that the controllers concealed personal assets, rights and values from the General Creditor Board in the judicial reorganization process.

Investors were right.

Montax discovered 4 farms and 2 equity companies opened in the name of third parties under the control of the majority shareholders, on the eve of the judicial reorganization, to house real estate, semmoventes (cattle) and shares of another investment bank.

Case Study – “Clone” Company

A leading regional multi-service medical clinic with innovative marketing technique suspected of corporate fraud.

Montax Intelligence discovered evidences that its Administrator had created “clone” companies, with identical corporate name and fantasy name, in his and his wife’s name, to misappropriate the values of the consultations.

The Financial Intelligence Report produced and the evidence accessed by Montax served as the basis for dismissal for just cause, initiation of a police inquiry for misappropriation and Precautionary Measure for the preparatory search and seizure of the Private Criminal Action, required by article 524 et seq. of the Brazil´s Code of Criminal Procedure in cases of crimes against industrial property.

Case Study – Swindler Customer

Leading company in the recycling market was hired by a smaller competitor, by e-mail, to dispose of construction waste in order to obtain Certificates from environmental agencies.

The service taker did not pay the bill, and the environmental company identified serious compliance failures.

Montax discovered that the client was, in reality, a gang of swindlers.

Its leader and other members were identified, as well as the asset protection scheme and money “laundering” in the purchase of real estate through real estate business powers of attorney and purchase and sale deeds in the wife’s name, not registered in the Registry of Properties.

Be sure to close deals online, but first, make sure that people and organizations De facto exist and what their operations are in the offline universe.

Case Study – Conflict of Interest of the Controlling Shareholder

Controlling shareholder usually wants the best for the company, doesn’t he? Not always.

Montax Intelligence was hired by the minority shareholders to obtain evidence of the controlling shareholder’s abuse of control power.

Suspicious accounting records indicated asset emptiness through “ghost” service providers.

Montax conducted an external audit of the company’s headquarters and found that they simply did not exist. And he got evidence of the equity – and suspicious – evolution of the controlling shareholder, with assets both in Brazil and abroad, and the constitution of a competing company, at the same time as the “fall” of net income and shareholder participation.

The controlling shareholder had improperly appropriated intangible assets such as organization, projects, know-how, specialized labor, computerized systems, marketing briefings and the company’s customer list to favor a company belonging to the economic group hidden from minority shareholders.

Case Study – Conflict of Interest II

A leading chemical industry innovation company hired Montax for Intelligence, Evidence Search & Investigations services after its commercial director abandoned its job.

Montax identified the corporate fraud consisting in the theft of trade secrets (in this case, the listing of clients) and the company that the former employee opened in open unfair competition.

During the research, Montax unwittingly identified a Conflict of Interest (COI) of the patent and trademark registration consultancy.

This company provided identical service to competing companies, however, without communicating the relevant fact, because it had promoted the registration of identical trademarks of similar products to competing companies (!).

Investment funds may hold values from individuals with high insolvency rates.

Case Study – Asset Search Abroad

A South Korean multinational manufacturer of electronic equipment has not received million-dollar invoices for the sale of parts and components to a national distributor.

China with its cheap labor and highly competitive prices ended the Brazilian industry, starting with the electronics market.

Bankrupt, the company’s controller could not pay suppliers.

In fact, he didn’t want to. It maintained the same standard of living of luxury and ostentation.

Montax was hired to do what they do best, Asset Search & Investigations and anti-money laundering actions.

Several controlling shareholder properties were identified and listed with more than 30 offshore companies in the Tax Havens of the Bahamas, Cayman Islands, British Virgin Islands and the state of Delaware (USA), which allowed for a debt settlement agreement.

We teach searching for assets in Brazil and in at least 3 states of the United States of America in our online course Success in Execution and Pledge, Creditor Manual – Financial Intelligence for Asset Search and Credit Recovery.

Case Study – Fraud to the Bidding Law

An information technology company was wrongly accused of unfair competition by the public bidding participant to sabotage its government business.

It counterattacked by hiring Montax to check the background of the slanderous competitor’s owners and vulnerabilities.

Montax discovered that the adversary’s partners defrauded the Bidding Law by creating a successor company on behalf of third parties (“strawman”), to escape the registration of disreputable companies of the Brazil´s Union General-Comptroller.

The partners also collected debts, and Montax accessed evidence of money “laundering” and concealment of assets through a Bank Credit Bill (CCB, its acronym in Portuguese) used to prevent the tracking and blocking of values by the Bacen Jud, the Justice Asset Search System (currently SISBAJUD) of online attachment.

Case Study – Industrial Property vs. Antitrust Laws

A funeral insurance company with a strong presence in the Southeast of the country was sued by the competitor, based on brand “plagiarism”.

Montax Intelligence listened to the client company’s industrial property lawyers, conducted market research, accessed data, information and was able to access evidence that the competitor strategically abused the Industrial Property Law to harm free competition.

It looked like a normal case of looking for evidence for a simple industrial property litigation, but the corporate investigation revealed several Deposits at the Brazil´s National Institute of Industrial Property (INPI) of multiple trademarks and common expressions of the industry and advertising campaigns, one evidence of violation of the Law Economic for abuse of economic power and violation of the economic order subject to federal investigation by the Administrative Council for Economic Defense (CADE) of Brazil.

Brazil is a democratic State whose main foundation is the principle of free enterprise, making any attempt at monopoly a crime.

Case Study – Passport & European Citizenship

A Brazilian living in Italy for more than 10 years found it difficult to prove his European (Portuguese) descent because he could not find documents from his grandfather, a Portuguese who immigrated to Brazil in the 1940s.

Without proof that he was the grandson of a citizen of Portugal, despite living in Europe for so long, the Brazilian could not get citizenship.

He requested research from Montax, which obtained certified personal documents from the grandfather, allowing the individual customer to obtain European citizenship.

Montax consulted “Conservatórias” (notary offices) in Portugal; Church Archdioceses of Brazil; Civil and cultural associations and even the National Archives can access the Foreigner Registration Record with a certified copy of the grandfather’s old Portuguese passport.

The brazilian trusted Montax and got portuguese citizenship and now lives in Europe with the status of a european citizen.

European Citizenship and Passports are invaluable assets and services such as documentation, paralegals and the search for evidence are highly specialized, but they are well worth the investment..

Case Study – Defamed Company

An oil and gas services company valued at R$50 million received an anonymous e-mail with defamatory content against directors and technical employees, displeasing the targets of the defamation.

Top management was curious to identify the author of the messages and worried about the possibility of him/her being part of the corporation’s staff.

The slanderer had opened a fake e-mail account with no apparent traces, solely to send the message.

Montax Intelligence fully identified the author of the messages in just 3 hours, a former employee regretting leaving the company to join the competitor’s staff who felt discredited when his readmission request was denied.

Case Study – Concealment of People and Assets

A leading regional accounting services firm has not been paid for tax credit recovery services – tax liability reduction – from a declining oil carrier.

After 8 (eight) years “fighting” in court to recover its assets, the creditor company discovered that the debtor company was bankrupt, its partners did not maintain assets in their names, accumulated debts of approximately R$ 200 million.

The assets pledged by other creditors were insufficient to pay tax and labor debts, and their partners disappeared in order not to pay debts.

Montax Intelligence managed to locate the partners in 30 days, identified a successor company, the fate of the fortune (Paraíso Fiscal) and a holding company that housed fixed real estate assets in the name/CPF of an “strawman”.

With this strategic information, the reluctant debtors sat down at the negotiating table and signed an agreement to pay 1/3 of the debt, with interest and monetary correction, a reasonable amount for those who had lost hope after eight years with no guarantee of receipt.

Case Study – Defrauding Employee

The largest car dealership in the Brazil noticed vacuums in the computerized system for controlling car stocks caused by an employee in a position of trust.

He did not enter entries and exits in the database to misappropriate both sales values and vehicles. And to favor a third party.

Montax Intelligence discovered that the business partner was, in reality, a company owned by the employee, who ran an economic group of companies formed in the name/CPF of “strawmen” to defraud his employer.

In addition to the obvious conflict of interests, the partners De jure (“strawmen”) and de facto (hidden), real fraudsters, were identified.

We also access evidence of the connection between the internal and external fraudster and private property purchase and sale Deeds (“drawer” contracts), the mechanism of “laundering” or concealment of assets, rights and values that hindered the recovery of assets.

Case Study – Shell Company

A multinational food production and distribution giant was not paid for several shipments of goods purchased by a supermarket chain in the city of São Paulo-SP.

Proceeded in court, the defrauded company could not locate either the debtor company or its partners.

Montax Intelligence discovered that the entire supermarket chain was actually made up of a variety of simple people with no control over the business, most likely “orange”, among them people from another state of the federation.

The client company chose to withdraw from asset recovery actions after Montax warned that there was strong evidence that the supermarket chain was controlled and laundered money for a faction of organized crime in Brazil.

ABOUT THE AUTHOR

MARCELO CARVALHO DE MONTALVÃO is the director of Montax Intelligence, franchise of private Intelligence services such as Compliance, Investigation, Due Diligence and Asset Search that has assisted large law firms and legal departments of companies such as PSA Group (Peugeot Citroën), Cyrela, LG Eletronics, Localiza Rent A Car, Sara Lee, Kellog, CWA Consultores, Geowellex, Sonangol Oil & Gas, Chinatex Grains and Oils, Generali Seguros, Estre Ambiental , Magneti Marelli, Pan Bank, BTG Pactual Bank, Alfa Bank, W3 Engineering and many other trademarks.

A Criminal lawyer specialized in Economic Criminal Law and financial crimes such as fraud in the execution, laundering or concealment of assets, rights and values and reverse engineering of asset shielding for the solution of millions fraud schemes.

Author of the book “Intelligence & Industry – Espionage and Corporate Counterintelligence”

Connect with Marcelo on LinkedIn

Listen to Marcelo on YouTube

Due Diligence | Asset Search | Corporate Investigation | Compliance Intelligence

Rio de Janeiro – RJ

Rua Figueiredo Magalhães, 387/801 – Copacabana – CEP: 22031-011

Telefone + 55 (21) 2143-6516

WhatsApp +55 (21) 98102-2001

E-mail montax@montaxbrasil.com.br

Montax Inteligência Ltda.

CNPJ 11.028.620/0001-55

Copyright © 2009